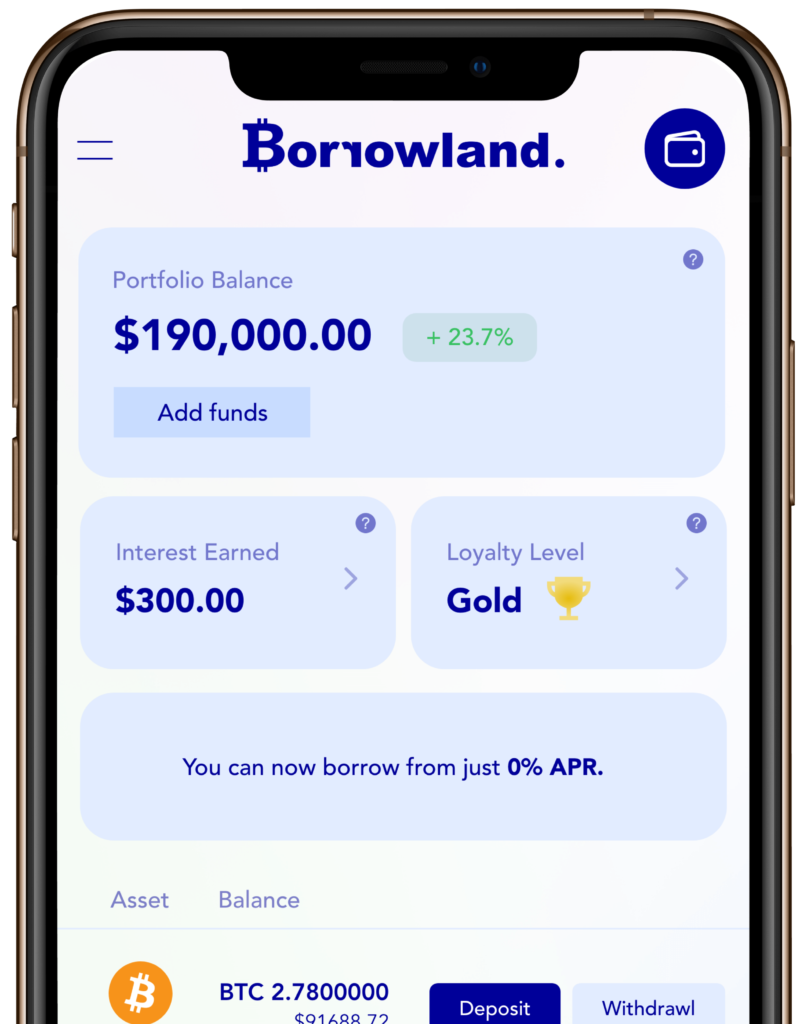

Borrow Funds Instantly.

Keep Your Crypto.

- Unique daily payouts

- Flexible earnings

- No origination fees

- Available from $50 up to $2M

All retail loans are issued by Borrowland Investment Technology Limited. Subject to Borrowland’s Term of Use and the terms of the applicable loan agreement. Rates effective for new loans requested as of May 2,2022. Borrowland loans are not available in all locations. Check your Borrowland mobile app to see if you live in an area where such loans are offered. Additional limits may apply in certain jurisdictions.

Why Borrow With Borrowland

Get as much or as little as you want, whenever you want with the most flexible crypto credit line out there.

Industry-Leading Rates

Instant Approval

No Installments

Easy Repayment

Borrow With Up To 60% LTV Rates

Experience industry leading loan-to-value (LTV) rates. This signifies the value of your loan as a percentage of your collateral. Get rates from 0% to 12% depending on your terms, choose between 1,3 and 6 month loan tenures. It is a very flexible service, so you can switch between premium rates and our standard offering.

Not a Conventional Loan. But a Smart Credit Line.

Instant Crypto

Credit Lines

Conventional

Loans

Opportunity to grow

your portfolio

Lower interest rates

No paperwork to fill

No monthly repayments

No impact on credit score

See how much you can borrow

Get cash, without selling your crypto.

See how much you can borrow with a crypto-backed loan.

Borrow Against Your CryptoTotal Loan Amount

USDC

Stablecoin minimum: $100, USD minimum: $1,000

Collateral

BTC

Interest Rate 12.00% 9.00%

50% LTVPaid in Borrowland

Loan Term 12 months

Total Loan Amount

$100

Monthly Interest

$1.00

Total Interest

$12.00

Coming soon!

Interest payments are made on a monthly basis, principal amount returned at the end of the loan term. Interest rates vary depending on your choice of LTV (Loan to Value). Minimum loan term is 6 months. If you repay your loan prior to the lapse of 6 months, you will be charged with the interest payable for the first full 6 months. Borrowland’ Terms of Use apply.

How To Get Started

- Top Up Collatoral

- Click on the "Top Up" button. Copy the top-up address and transfer the assets you wish to use as collateral.

- Your Credit Line is Instantly Available

- Once you top up, you will be able to borrow immediately with no credit checks. Your available limit will be calculated depending on the value of your assets.

- Start Spending

- Withdraw cash or stablecoins without any delays. You will be charged interest only on the amount you actually withdraw.

Protecting You Even Under Extreme Market Conditions

Borrowland provides you with tools to monitor your credit line health and preserve the value of your collateral even in a market downturn.

more information about borrowland

FAQ

In simple terms, blockchain is a system of recording information in a way that makes it difficult or impossible to change, hack, or cheat the system.

A blockchain is essentially a digital ledger of transactions that is duplicated and distributed across the entire network of computer systems on the blockchain. Each block in the chain contains a number of transactions, and every time a new transaction occurs on the blockchain, a record of that transaction is added to every participant’s ledger. The decentralized database managed by multiple participants is known as Distributed Ledger Technology (DLT).

Bitcoin is a form of digital currency that aims to eliminate the need for central authorities such as banks or governments. Instead, Bitcoin uses blockchain technology to support peer-to-peer transactions between users on a decentralized network.

Transactions are authenticated through Bitcoin’s proof-of-work consensus mechanism, which rewards cryptocurrency miners for validating transactions.

Launched in 2009 by a mysterious developer known as Satoshi Nakamoto, Bitcoin (BTC) was the first, and remains the most valuable, entrant in the emerging class of assets known as cryptocurrencies.

Borrowers will send their bitcoin to the platform as collateral, and they can choose to get a loan of up to 70% of their collateral. They also have to choose how long they want to borrow money for, which means they choose their loan by the amount that exists in the one, three or twelve month pools. If the price of their collateral drops near to the amount of money they have borrowed, the platform will sell their collateral and pay that amount back to the lenders.

People will first deposit their USD into the platform in terms of a one, three or twelve month period, or pools. They choose how long they want to lend their coins to borrowers. Lenders who choose a longer term will earn more money in comparison to those who choose shorter terms. The platform will decide the rates based on the market average and on an equation that takes into account the number of lenders versus borrowers. Moreover, if the situation of the market later changes, it will adjust the rates to fit the current situation to keep the balance in each pool. The borrower can then choose to borrow from those pools. If there is no liquidity (money) in a pool, the platform will let the borrower try at a later time.

Financial Freedom

With Borrowland.

No minimum balance required

No minimum balance because everyone deserves to have unparalleled access to fair, rewarding financial services.